The BSE Sensex and NSE Nifty fell for the third straight session and hit their fresh 52-week lows on Wednesday on rising concerns over a spike in bad loans of public sector banks amid global sell-off. Sensex closed 262 points down at 23,758.90, while Nifty settled 76.80 points down at 7221.40. Weakness in the Indian rupee against dollar too weighed on the market sentiment.

In the Nifty 50 pack, share price of Punjab National Bank slid the most — 9.12 per cent, followed by Tata Motors (down 7.07 per cent), Bank of Baroda (down 5.95 per cent), Cairn India (down 5.92 per cent) and State Bank of India (down 4.82 per cent). On the other hand, HCL Technologies, UltraTech Cement and BPCL gained 2.65 per cent, 1.87 per cent and 1.59 per cent, respectively.

READ: Sensex hits fresh 52-week low, Nifty drops below 7,200 today; 5 reasons behind the fall

Sectorwise, the BSE Realty index, BSE Bankex and BSE Healthcare index plummeted 3.46 per cent, 2.04 per cent and 1.55 per cent, respectively on Wednesday. Rest all other sectoral indices also ended in red.

In scrip specific development, state-run lenders Central Bank of India (down 12.37 per cent), Dena Bank (down 4.36 per cent) and Allahabad Bank (down 9.61 per cent) slipped lower on reporting massive losses on Tuesday, while Punjab National Bank continued its downfall as the growing pile of stressed loans took a toll on their health, raising concerns over the precarious state of the financial sector.

Indian tyre stocks rallied on market expectations that the government may impose minimum prices for tyre imports or announce an outright ban on inbound shipments. Shares of Apollo Tyres and Ceat gained 10.70 per cent and 4.68 per cent, respectively, on Wednesday.

READ: Top 10 stocks that hogged limelight in today’s trade: Eros International, Hinduja Global Solutions, PNB and more

Overall market breadth remained negative, as there were 653 shares on the gaining side against 1,995 shares on the losing side while 105 shares remain unchanged.

Asian peers ended in red on Wednesday, as the collapse of oil prices and fresh worries that a new banking crisis could erupt in a fragile global economy added to the risk-off mood. Shares fell across the region despite oil prices seeking some rebound from overnight losses on news that Iran is ready to talk with Saudi Arabia over the current conditions in international oil markets. Japanese shares hit a 15-month low as the dollar slid from the lower 115 yen range to the mid-114 yen zone on concerns over global market volatility and worries over financial institutions in Europe and the US. The markets in South Korea, Taiwan, China and Hong Kong remain closed for the Lunar New Year holiday.

————————————————————————————————————————–

Market through the day

3.30 pm: Sensex closed 262 points down at 23,758.90, while Nifty settled 76.80 points down at 7221.40. Weakness in the Indian rupee against dollar too weighed on the market sentiment.

3.10 pm: Meanwhile, amid increasing global headwinds, Crisil Research in its report has said that Indian economy is expected to grow at 7.9 per cent in the fiscal year 2016-17, lower than earlier forecast of 8.1 per cent and higher from 7.6 per cent expected in the current fiscal, if supported by a normal monsoon. According to the report, growth in the next fiscal will find mild support from improved transmission of the RBI’s policy rate cuts and the implementation of the salary and pension revisions recommended by the One Rank One Pension Scheme and the Seventh Pay Commission.

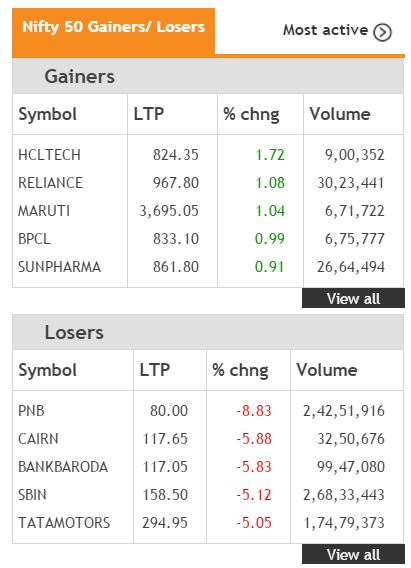

3.00 pm: Sensex was down 251 points at 23,769. Nifty was down 78.70 points 7219.50. In the 50-share index, HCL Technologies, Reliance Industries, Maruti Suzuki, BPCL and Sun Pharma were up between 0.90 per cent and 1.73 per cent. On the other hand, Punjab National Bank, Cairn India, Bank of Baroda, State Bank of India and Tata Motors were down between 5.04 per cent and 8.85 per cent.

Nifty – top gainers and losers at 3.00 pm

2.32 pm: The initial public offer (IPO) of software provider Quick Heal Technologies has been oversubscribed 1.81 times till afternoon on the last day of the offer today. The Rs 451-crore IPO received bids for 1.83 crore shares against the total issue size of over 1 crore shares, data available with the NSE till 1.00 pm showed. Quick Heal has already raised Rs 133.9 crore through issue of shares to 10 anchor investors.

2.20 pm: European shares rebounded back up on Wednesday from two-year lows reached in the previous session, helped by some solid corporate earnings and signs of corporate takeover activity. The pan-European FTSEurofirst 300 index recovered slightly to rise 0.4 percent. Sensex was trading 181.71 points down at 23,839.27. Nifty traded 64.90 points down at 7,233.30.

2.02 pm: Meanwhile, Lakshmi Vilas Bank announced reduction in the base rate from the earlier rate of 10.70 per cent pa to 10.55 per cent per annum. The revised rate is effective from February 8, 2016. Base rate is the benchmark rate to which all lending rates are linked. The said reduction is applicable to the existing as well as future loans. Shares of Lakshmi Vilas Bank were trading 2.54 per cent down at Rs 92. Sensex was down 333 points at 23,687.

2.00 pm: Mindtree shares were trading 0.08 per cent up at Rs 1482.10. i-exceed technology solutions, a Bangalore based technology products and services company, on Wednesday announced its partnership with Mindtree. In this partnership, Mindtree will leverage i-exceed’s flagship mobile app development platform, Appzillon to deliver mobility solutions for the BFSI sector.

1.58 pm: The market breadth on the BSE was negative; there were 470 shares on the gaining side against 2,007 shares on the losing side while 103 shares remain unchanged.

1.48 pm: Nifty dropped below 7,200 mark and was trading 103.65 points down at 7,194.55. Sensex was trading 345 points down at 23,675.

1.16 pm: Sensex fell to their lowest levels since May 2014 on Wednesday, with State Bank of India leading the losses ahead of its financial results that are expected to disappoint just as other major state-run banks did this quarter. State Bank of India shares were trading 2.72 per cent down at Rs 162.45. Sensex was down 222.90 points at 23,798.

1.08 pm: SRF shares were trading 0.88 per cent up at Rs 1,166.80. SRF has reported 14.47 per cent rise in its net profit at Rs 83.13 crore for the quarter ended December 2015 as compared to Rs 72.62 crore for the same quarter in the previous year. However, the company’s total income decreased by 1.80 per cent to Rs 870.44 crore for the quarter under review from Rs 886.40 crore for the corresponding quarter of the previous year.

1.05 pm: Traders were seen piling position in IT and TECk stocks, while selling was witnessed in Realty, Bankex, Metal, PSU and Auto sector stocks. The benchmark index BSE Sensex was down 205 points at 23,815. Nifty was down 67.30 points at 7,230.90.

1.02 pm: Bond yields traded lower on Wednesday after the Reserve Bank of India (RBI) said that government will repurchase the 1.44 per cent inflation-indexed bonds (IIBs) maturing in 2023 through a reverse auction on February 11.

12.50 pm: Sensex was down 164 points at 23,856. Cipla shares were trading 1.26 per cent down at Rs 549.50 ahead of its December quarter earnings. According to Reuters estimates, Cipla’s net income may may come in at Rs 414 crore as against expected Rs 428 cr.

12.24 pm: Jubilant Life Sciences shares were trading 3 per cent down at Rs 344.60. The company on Tuesday reported a net profit of Rs 116.93 crore for the third quarter ended December 31. The company had posted a net loss of Rs 11.16 crore during the same period of previous fiscal. Sensex was down 195 points at 23,825.

12.13 pm: Benchmark indices BSE Sensex and NSE Nifty down over 20 per cent from their record highs. Sensex hit closing high of 29,593.73 last seen on March 3, 2015.

11.59 am: Sensex was down 176 points at 23,844. NHPC shares were trading 1 per cent up at Rs 20.80. NHPC has restored Unit-2 of its Chutak power station in Jammu and Kashmir (J&K) with effect from February 04, 2016. The unit was shut down from October 25, 2015 due to problem in water parts.

11.23 am: Shares of Dr Reddy’s Labs were trading 3.32 per cent down at Rs 2, 861.30. Dr Reddy’s Laboratories on Tuesday posted a marginal increase in consolidated net profit at Rs 579.2 crore for the third quarter ended December 31, hit by weak sales in the emerging markets like Russia, CIS nations and Romania.

10.59 am: Hinduja Global Solutions shares tanked as much as 12.50 per cent in the morning trade on Wednesday after the company reported 67.60 per cent fall in its net profit figures at Rs 171 crore for the quarter ended December 2015. The company earned Rs 528 crore in the corresponding quarter a year ago. Sensex was down 220 points at 23,800.

10.15 am: Sensex was down 184 points at 23,836. Brokers said sentiment remained weak as participants indulged in offloading their positions, tracking a weak trend in Asian region following overnight losses in the US market as investors grappled with weakness in overseas equity markets and another drop in oil prices.

10.09 am: The rupee depreciated 6 paise to 67.96 against the US dollar in early trade at the Interbank Foreign Exchange market due to increased demand for the American unit from importers and banks amid a lower opening in the domestic equity market. Sensex was down 192 points at 23,829.

9.56 am: Nifty and Nifty Bank index also hit their new 52-week low in today’s trade. The Nifty IT index was trading 0.16 per cent up at 10,630.80.

9.42 am: Allahabad Bank shares plunged as much as 10.98 per cent in the early trade on Wednesday after the Kolkata-based bank reported a loss of Rs 486.14 crore for the third quarter ended December 2015. The bank had earned a net profit of Rs 164.11 crore in the same quarter last year. Meanwhile, Sensex hit its new 52-week low on global sell-off.

9.32 am: Punjab National Bank shares were down 5.29 per cent at Rs 83.20. The scrip is under pressure after the bank reported 93 per cent year-on-year fall in its net profit figures at Rs 51.01 crore for the quarter ended December 2015. The bank reported net profit of Rs 774.58 crore in the same quarter a year ago. Nifty Bank index was down 0.89 per cent at Rs 14743.20.

9.30 am: Tech Mahindra shares hit their fresh 52-week low of Rs 442 in the early trade. The scrip was trading 0.98 per cent down at Rs 443.25. Sensex was down 141.19 points at 23879. Nifty was down 48.10 points at 7,250.

9.23 am: Butterfly Gandhimathi Appliances shares were trading over 7 per cent down at Rs 230.10. The company on Tuesday reported 264.14 per cent rise in its net profit figures to Rs 1.06 crore for the quarter ended December 2015. The company earned 0.29 crore in the corresponding quarter a year ago.

9.16 am: Sensex was down 133.82 points at 23887.16. In the 30-share index, Tata Motors, ICICI Bank and Dr Reddy’s Labs were down by 3.41 per cent, 2.37 per cent and 1.55 per cent. Nifty was trading 43.10 points down at 7,255.

9.15 am: The BSE Sensex and NSE Nifty opened in red on Wednesday on the back of weak global markets. Sensex opened 82.66 points down at 23,938, while Nifty50 index opened 33.90 points down at 7,264.30.

8.45 am: Domestic equity markets are set for another gap down opening on Wednesday tracking Nifty futures on the Singapore Stock Exchange (SGX Nifty) and weak global markets.

At 8.30 am (IST), SGX Nifty was down 63.50 points, or 0.87 per cent, at 7,264.50.

Asian stocks plunged early on Wednesday amid growing concerns about the health of the global banking sector, particularly in Europe, while the safe-haven yen stood near a 15-month high versus the dollar.

Japan’s Nikkei, which sank more than 5 per cent on Tuesday, extended losses to hit a 16-month low. The index was down 2.40 per cent.

The Dow Jones industrial average fell 12.67 points, or 0.1 per cent, to 16,014.38. The Standard & Poor’s 500 index lost 1.23 points, or 0.1 per cent, to 1,852.21. The Nasdaq composite index slid 14.99 points, or 0.4 per cent, to 4,268.76.

Back home, the BSE Sensex on Tuesday slumped by 266.44 points to 24,020.98 on sustained foreign fund outflows, while IT stocks fell after Cognizant lowered revenue guidance for the year. The 50-share NSE Nifty dipped below the psychological 7,300-mark by tumbling 89.05 points or 1.21 per cent to close at 7,298.20.

Shares of Aurobindo Pharma and Allahabad bank will remain in focus on Wednesday. Aurobindo Pharma on Tuesday reported a consolidated net profit at Rs 534.95 crore for the third quarter ended December 31, 2015. The pharma company had posted a consolidated net profit of Rs 384.35 crore in the same period last fiscal.

Public sector Allahabad Bank reported a loss of Rs 486.14 crore for the third quarter ended December 31, due to higher provisioning against bad loans. The bank had earned a net profit of Rs 164.11 crore in the same quarter last year.

Crude oil futures extended their slump on Tuesday and once again neared their 12-year lows, after a report from the International Energy Agency (IEA) forecasted a further widening of the supply-demand imbalance on global markets. The IEA said its global oil demand growth is forecast to ease back considerably in 2016, to 1.2 mb/d, pulled down by notable slowdowns in Europe, China and the United States. It now expects prices to average $37.59 a barrel this year, down from a previous forecast for a 2016 average of $38.54.

(With agency inputs)