If you’ve followed the clean energy debate for some time (and you’re on this website, so it’s likely) you’ll know of a familiar gambit to critique wind and solar – creating an impossible failure and always claiming that it’s failing. The blackout in Texas has caused a resurgence of many of these old ideas, and it’s worth exploring them, because they highlight exactly what role wind power will play in increasingly stressed world grids.

First came a claim that Texas’ relatively large fleet of wind power had frozen. There is still little clarity on this. ERCOT claimed half the state’s wind turbines were frozen, but we don’t know for how long. I looked at wind output in other regions, and it roughly matches the profile of Texas, suggesting that whatever role this played in wind’s output, it was limited. An analysis from Wood Mackenzie confirms earlier statements from ERCOT that for around half a day, about half the state’s wind fleet were impacted in some way by icing. “Incentivising cold-weather equipment for Texas turbines after the last massive ice storm in October 2020 could have ensured a faster rebound from the wind fleet”, said WoodMac.

Did anything else go wrong?

The question of wind speeds

The output of the state’s 32 gigawatt fleet of wind turbines has been relatively low, during the big demand crunch moments. It’s this low output that has been cast as a massive failure in the technology. It’s an old argument: wind and solar are inherently unfit for delivering electricity, because their output is variable. The same line has been prosecuted for decades, and it has seen a resurgence, as climate denial blogs and renewable energy opponents eagerly share charts showing low wind output during the blackout.

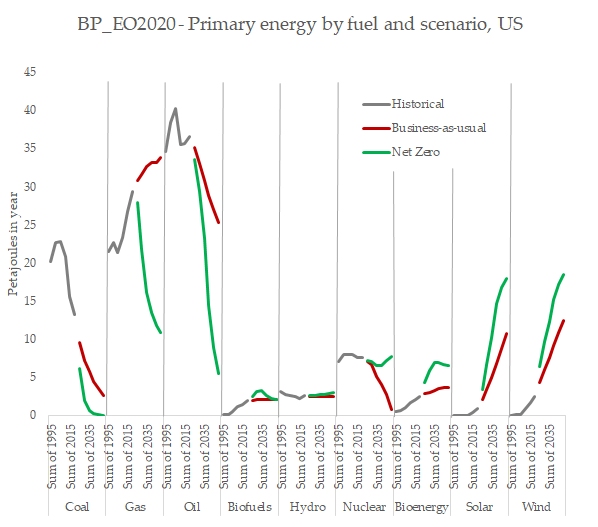

A range of integration techniques, such as energy storage (hydro, battery), other technologies like geothermal or concentrating solar thermal, along with good planning, new transmission lines, demand response and demand reductions all combine to enable truly massive quantities of VRE in grids. Every model you’ll see now of future grids involves wind and solar serving as the bulk of power – even the most skeptical and pessimistic ones, including those originating from the fossil fuel industry itself.

What Texas shows is that relying on gas-fired power as a ‘transition’ fuel, instead of a diverse mix of new integration options designed to be resilient to climate impacts, is actually the new danger. There’s a similar pattern in Australia’s NEM, where coal is buckling under heat stress in key moments, and investments to provide zero carbon backup for wind and solar are going a lot slower than the roll-out of wind and solar.

There was no mandate from human life in Texas demanding that the atmosphere supply high quantities of kinetic energy during moments of high demand, bad thermal plants failures, or both. But wind has been treated as if there was – as if the fact wind speeds were varying normally as they have always done was somehow a “failure” or “under-performance”.

These fluctuations are no mystery, either – we can forecast them.

The forecasting conundrum

What Texas shows is that the absence of any agreed meaning of “performance” for wind and solar causes massive problems when discussing events like this.

One recurrent problem on Twitter coverage of the blackout was asserting that renewables either over or under performed based on charts of power output compared to ERCOT’s hourly forecasts.

Wind generation in Texas is outperforming forecast by a factor of 3.3. 2,000MW at 12 noon; forecast 600MW. @ERCOT_ISO screencap for those outside U.S. https://t.co/TIaR0bDymL pic.twitter.com/BbXaoVDkY7

— Nat Bullard (@NatBullard) February 17, 2021

This is obviously something of a reaction to the fake conservative narratives, but it’s not quite right.

Every wind and solar power forecasting system in the world has some proportion of error baked in – that’s the hazard of predicting the future, and it’s the same for predicting demand. It is sometimes above, and sometimes below. The “COP HSL” on the lower half of ERCOT’s wind forecast page refers to “Current operating plan – Highest sustained Load”. Basically, it’s the middle-line of their forecast. There’s an approximately 50% chance of exceeding this, or being below it. Neither instances are under or over performance; and a sustained lean to one side suggests a problem with the forecasting system, and potential flow-on problems with grid management.

Germany makes data on its massive wind and solar fleet available, so you can compare what was predicted and what actually happened. There is error, but it is within defined bounds, and for the most part what’s forecasted ends up close to what happens:

That error is, for ERCOT, probably decreasing as the system ‘learns’ the nuances of operation. It is almost impossible to find similar forecast performance data for ERCOT, and they’ve faced criticism from market participants on social media for under-performance in their wind forecasting. They actually use two vendors for wind forecasting and one for solar, suggesting there has at least been recent improvement.

US consultancy Genscape, owned by Wood MacKenzie, has highlighted errors in forecasting as a rising risk, paired with growing wind power capacity constrained by limited transmission and fossil fuel plants that are unable to ramp quickly enough to match variations in wind and solar. In fact, ERCOT’s current Director of Operations, Dan Woodfin, highlighted the challenges of incorporating icing events into the operator’s real-time wind forecasts, back in 2016. As wind grows in Texas, this challenge will probably need to be addressed – but again, it’s actually pretty tough to get clarity on the scale.

The only real way of answering this question would be getting our hands on every run of the wind forecast over the week, and comparing it to actual wind farm output, creating a similar scatter plot to the one above. It actually isn’t impossible that the forecast misinformed the operator, but even if it did, there’s nothing that Texas wind could ever have done to fully avoid blackouts.

That’s because the long term, seasonal forecasts of expected supply and demand were badly off the mark.

SARA and what it means to forecast the future

The other key discourse around Texas wind’s ‘performance’ has been a metric prepared by the grid operator in their “system resource adequacy assessment”, or SARA. The document that lists “expectations” for winter output from various resources in ERCOT was published last year, and the winter 2020-21 final seasonal assessment lists, for wind, a sum total of 6,142 megawatts of wind power during “peak load” events.

This value was used to judge the “performance” of wind during the blackout (easily within the definition of a peak load event). Energy expert Jesse Jenkins referred to it, it was used in a widely-shared graphic by Wood MacKenzie’s Wade Schauer, and the International Energy Agency used the ~6GW “expectation” to claim “Wind generation came up short of expected output”. WattClarity’s Paul McArdle characterised it this way: “‘well Willie Wind, we only expected a C grade from you, so you have done quite well with a C+ on this occasion!’”.

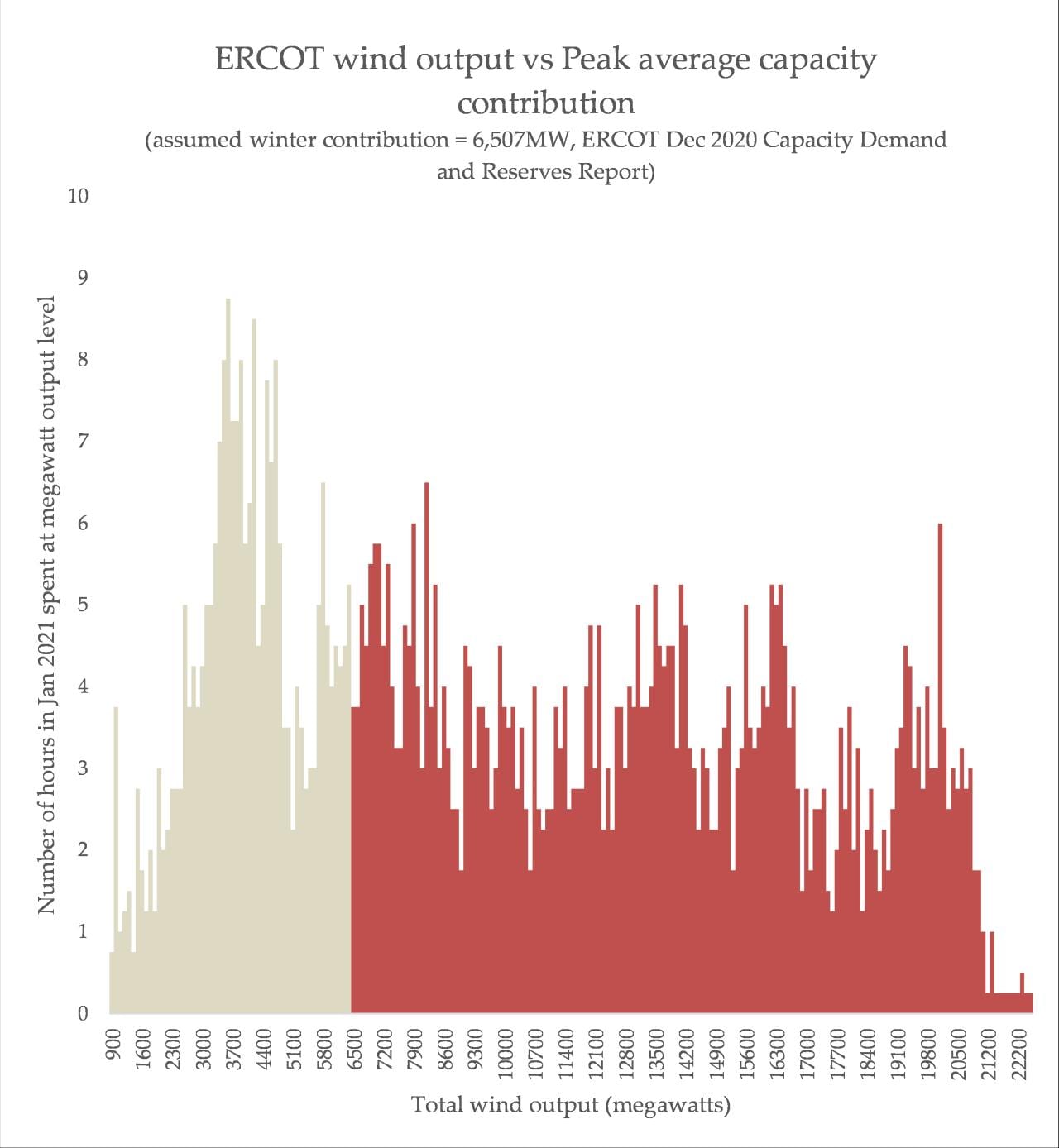

As I discovered quickly, applying this metric to the month of January shows that wind power in Texas sits above this assumption at most times, and will likely see similar numbers for February.

The implication here is that somehow, the grid operator has set a “minimum” wind speed capacity for moments of grid stress, and that it is a “failure” or “underperforming” if wind is below 6 gigawatts when gas-fired power plants shut down.

The general principle is extremely weird. Wind speed will always vary – this is a characteristic of the resource. There’s a non-zero chance of wind output being 0 gigawatts during peak loads: that is why hour and day ahead wind forecasts are used (and why their accuracy is vital).

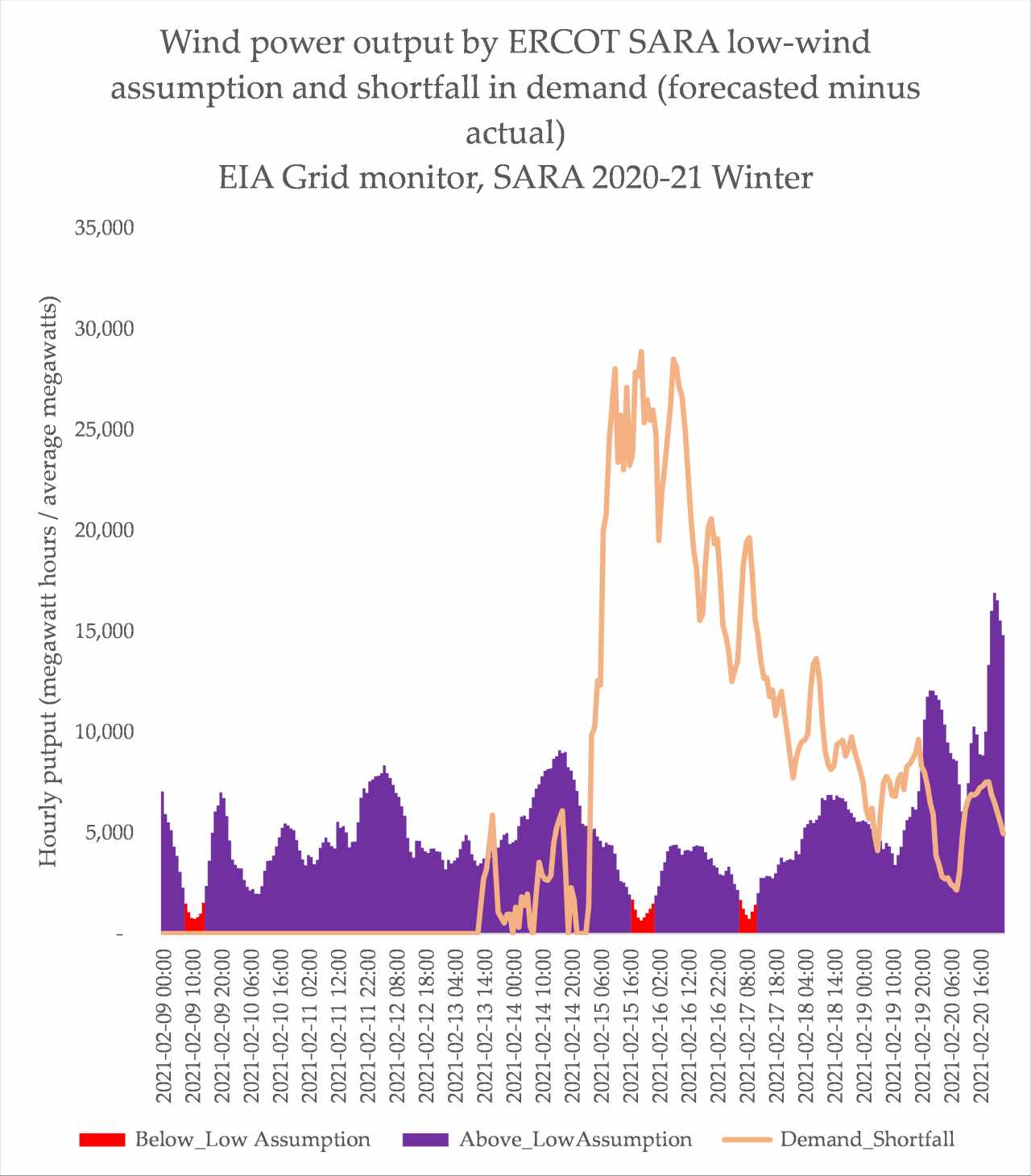

In fact, for the first time ever, ERCOT included a special “low wind” scenario in its resource adequacy assessment, as Professor Jenkins points out on Twitter. “This is this first spring assessment that includes a low wind output scenario, and even under this particular scenario, ERCOT anticipates there will be sufficient generation to meet the forecasted demand”.

This number is 1,791 megawatts, and is calculated from the average 5% percentile of wind capacity during the top 100 highest load hours. Wind power was above this level for the vast majority of the week:

Of the 143 hours since the event began in the early hours of the 15th, wind power in Texas was below the low wind assumption for 14 hours – about 9% of the total time. Considering these low wind moments occur 5% of the time in ERCOT’s big list of high demand moments, this isn’t too far from historical.

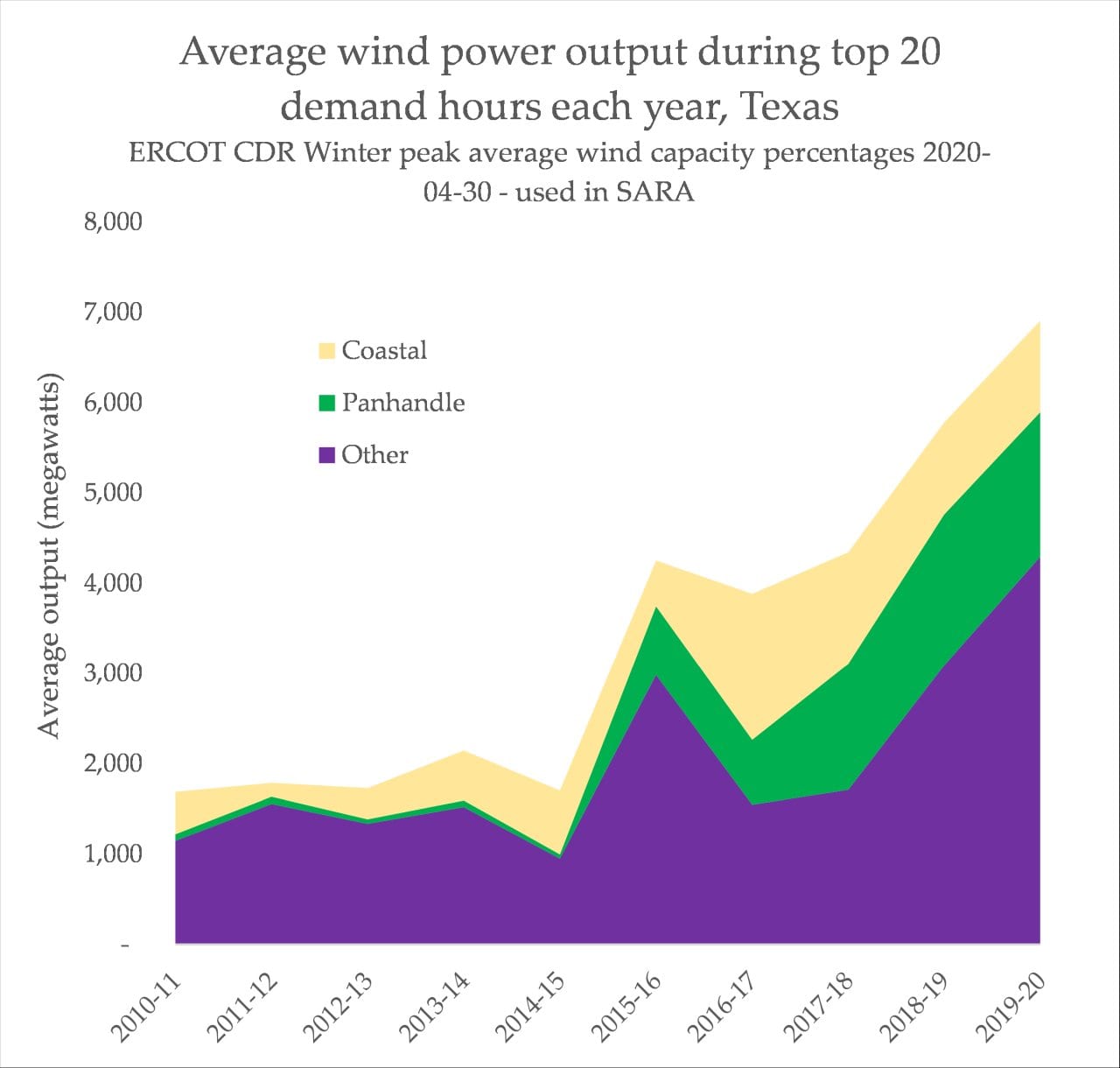

The 6 gigawatt value is calculated from the average capacity factor of the state’s wind fleet during the top 20 moments of peak demand over the past 10 years, in the state’s three regions (coastal, panhandle and other). They even share the actual file they’ve used to calculate it, and you can dig down into the distribution of wind power output during Texas’ various moments of high demand, over the years.

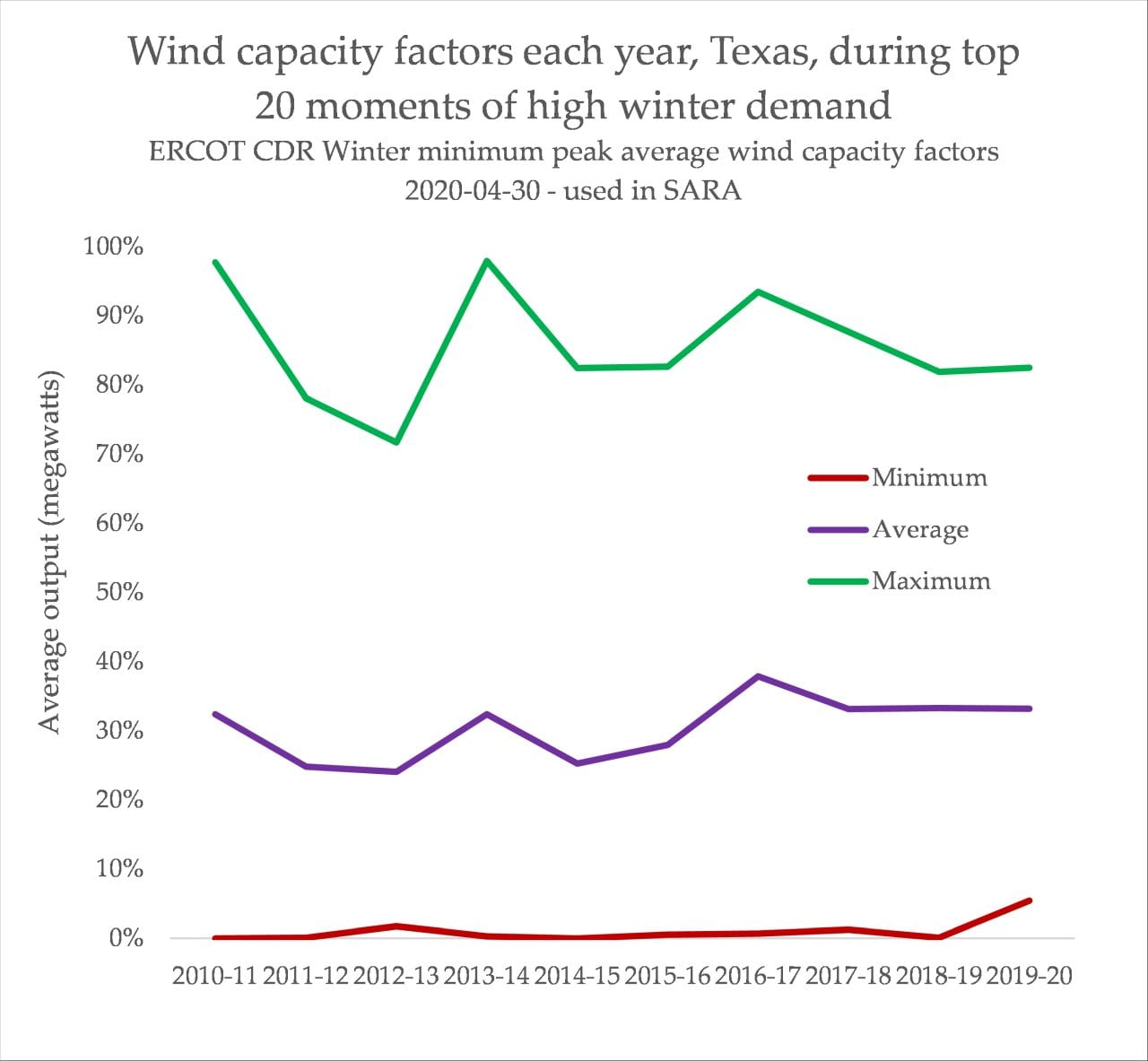

As is clear from the data, average wind output during moment of peak have been climbing steadily since 2010 due to the growth of the technology. Average capacity factor during peak demand hasn’t actually changed all that much, range from near 0% to up to around 80%, and averaging 30%.

However, as the state’s fleet of wind turbines has grown, the average capacity factor of those turbines during each year’s top 20 winter high demand hours has remained roughly the same, with the previous year seeing a slightly raised minimum due probably to more diverse project geographies across the state:

The average value that ERCOT have based wind power’s output is exactly that: an average, that also happens to flatten a wide range of potential output during peak periods. “Performance”, here is problematically being characterised as the dice-roll of wind output falling within the range of exactly what it’s expected to do, based on historical data. On February 2nd, 2011, a winter cold snap event that is startlingly similar to the most recent occurred. Gas infrastructure failed in the cold, demand shot up and blackouts ensued. The wind power data for that moment, when the fleet was roughly half the size it is today, is included in these peak average:

There is one criticism to be made of ERCOT’s treatment of wind resource in its planning. While it did include a “low wind” scenario, ERCOT did not combine this low wind scenario with a massive demand crunch and the failure of fossil plant- they were treated as completely separate scenarios, in their winter assessment.

The two most ‘extreme’ scenarios add another 9,508 megawatts of demand onto the forecasted peak, based off. They also add improbable (5% chance, based on historical) generator failures into that mix, but they do not combine it with a low wind output, which sits in its own scenario (where it’s paired with typical winter outages and demand).

Of course, it didn’t matter at all. The most extreme scenario predicted 13 gigawatts of thermal outages: last week, it was more than 30 gigawatts. Wind might have been in one of those high capacity-factor moments and that would have eased the pressure, but load shedding would still have been inevitable.

“14 GW of generation on outage is not an outlandish figure for late winter based on the past six years of data, despite it being used as an “extreme outage” case in resource adequacy planning,” wrote Wood MacKenzie analysts, on their site’s blog. “In the hypothetical case that the additional 18 GW of thermal generation had not been knocked out by the weather this week, icing had not limited the capacity of wind farms to produce additional power, and a gas shortage had not further constrained available generation, a load forecast of 74 GW would still have required approximately 3.9 GW of load shed and emergency conditions”.

The discourse around whether wind “caused” the event intentionally flattens a very interesting and important point: it is in fact possible to build out new energy technologies so they become redundant to a network of failing fossil fuel infrastructure. It means figuring out integration of wind and solar far quicker than expected, but as is becoming increasingly clear, we need to prepare for a world dominated by intermittent, unreliable fossil fuels with reliable, firm zero carbon power.